Presenting: Endeavor Cards

Table of Contents

In 2015, our economic model predicted a global stagflation hitting by 2020, as a consequence of the profit maximization doctrine of Economics, as well as the Keynesian quantitative easing that supports it.

This is why, from 2016, we have been creating a moneyless points-based economic system to address such an inflation.

This all was tested in 2020 when our app suddenly got a lot of users – these were people in lockdown or those who have lost their jobs because of the pandemic.

This caused our server hosting costs to rise. However, those hosting providers of course would not accept our points as payment.

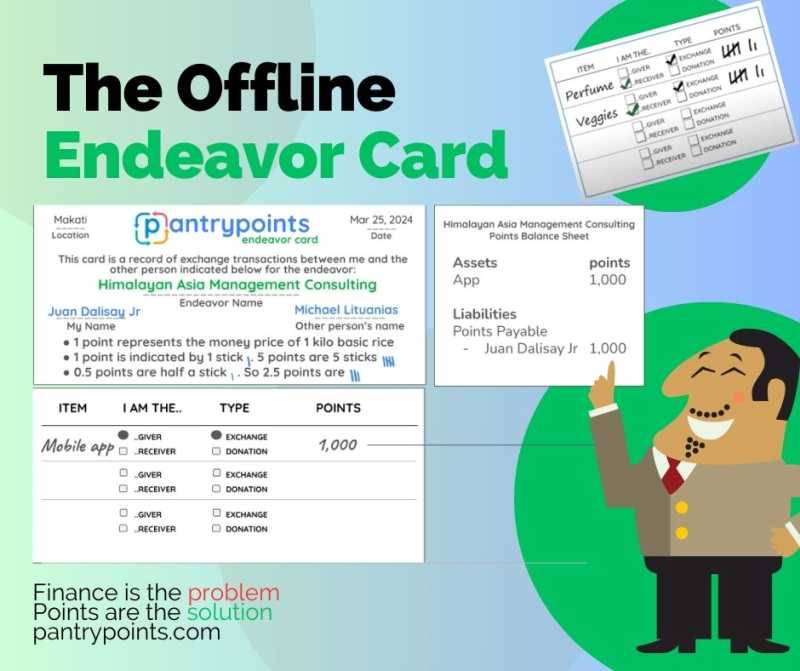

And so we had to create a truly moneyless system. The only way was through offline paper cards, similar to how the first bank notes were made of paper.

Economy-as-a-Service

This made us overhaul the whole system into an Economy-as-a-Service (EaaS), similar to a public utility just as the first minting of coins and printing of bank notes was a public utility.

This EaaS can be run in various ways, allowing maximum flexibility:

- On the cloud for scale

- On self-hosted servers for control

- On pen and paper for resilience

Last year, we tested the paper cards for personal transactions.

This year, we will test the cards for transactions with organizations and causes, which we call ’endeavors'.

This separates personal liability from that of the endeavor, which is really a group, or even a societal, liability.

In the example above, I make an app, let’s say costing 1,000 points, for Michael who is a decision-maker in the endeavor as a consulting business.

This would increase the assets of the business by 1,000 points. But instead of getting a money payment, I get a promise to pay. This creates a liability of 1,000 points for the business instead of reducing money assets by 1,000.

Anti-Recession, Anti-Inflation, Anti-Speculation

This prevents the business for getting starved of cash, which is one of the biggest reasons why companies close down, unable to generate employment.

The points are not pegged to money, but to rice, where 1 point is the market value of 1 kilo of basic rice. This reduces the impact of inflation since the price of rice is more stable than those of other commodities.

Moreover, this allows the liability to last as long as the lifetimes of either party, since rice will have a value to both while they are alive.

The liability is not easily transferred to other parties. This reduces the tendency to speculate with the buying and selling of the business.

The real problem is what happens when a person dies. Does it extinguish the liability? How will the surviving party get compensated?

For this, we turn to Al-Khwarizmi , the inventor of algorithms. He invented algorithms to solve how estates should be divided among heirs following the rules in the Quran.

In our case, how this algorithm works will depend on the data from the actual transactions in the endeavor.

The original post is here: https://www.linkedin.com/pulse/moneyless-system-businesses-juan-dalisay-jr--7gxec/